Why Having a Good Credit Score is Important

- By Greg Knotts

Reading time: 3 mins

Your credit score represents your financial health and proves to lenders your ability to manage debts. Showing lenders you can save money, pay debts on time, and establish a trustworthy credit history helps you borrow money.

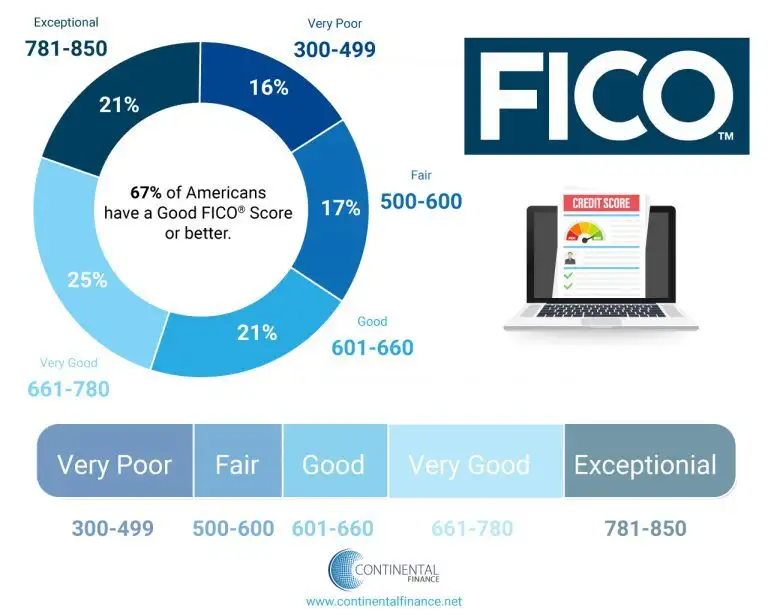

The major credit bureaus score each person based on their credit payment history. There are more than one scoring system, but they often range from 300 to 850 in rating.

The effect your credit score can have on your life

Your credit score can impact your life in many ways, including:

- Average to excellent credit scores can give you access to auto loans, mortgages, personal loans, and credit cards with lower interest rates.

- A fair credit score can typically get you credit services that you need, but with higher interest rates.

- While a poor credit score will usually get you declined for most credit cards, unless you apply for a secured credit card and provide a security deposit.

If you’re planning to buy a house, new car, or anything else that you can’t pay upfront, increasing your credit score should be your first step. If your credit score is too low, you might be declined for loans or end up paying sky high interest rates.

If you’re going to rent an apartment, landlords will check your credit score before they accept you as a tenant. If you have a bad credit score, landlords may feel that you’re a risky investment and you could have a hard time finding an apartment.

Simply put, the higher your score, the lower the interest rates and the better your chances of being approved for loans, credit cards, and other credit related products.

To give you an idea of how credit scores are weighed when credit checks are done, we’ve broken down the stats. Here you will find ranges for both FICO score ranges and VantageScore credit scoring:

What is a good FICO score?

FICO is one of the major consumer credit scoring agencies. Founded in 1956 and based in San Jose, CA, FICO has been providing its general-purpose FICO score since 1989. FICO scores are based on credit reports as well as other statistics like credit utilization ratio.

| Poor | Fair | Average | Very Good | Excellent | |

| FICO Score | 300 – 579 | 580 – 669 | 670 – 739 | 740 – 799 | 800 – 850 |

What is a good VantageScore?

VantageScore is an alternative consumer credit-scoring model that was created by and is a registered trademark of the three major credit bureaus: Equifax, Experian and TransUnion. The scoring system is kept separate from the credit bureaus.

The current model, VantageScore 4.0, debuted in 2017. It retained many of the updates from VantageScore 3.0 that consumers preferred. These features included changing the scale to fit the more comfortable 300 to 850 scoring range.

| Poor | Fair | Good | Excellent | |

| Vantage Score | 300 -579 | 580 – 669 | 661 – 780 | 781 – 850 |

A closer look at factors that affect your credit score

The information that sends your credit score up or down is different for each scoring system. But all credit scores, no matter the model, have these factors in common:

- Credit utilization rate

- Type, number and age of credit accounts

- Total debt

- Public records such as a bankruptcy

- How many new credit accounts you’ve recently opened

- Number of inquiries for your credit report

Factors specific to FICO

According to Experian, there are some factors that FICO weighs heavier than other scoring systems. Those factors are:

- Most influential: Payment history on loans and credit cards

- Highly influential: Total debt and amounts owed

- Moderately influential: Length of credit history

Factors specific to VantageScore

Also according to Experian, there are some factors that VantageScore weights heavier than other scoring systems. Those factors are:

- Most influential: Payment history

- Highly influential: Age and type of credit, percent of credit limit used

- Moderately influential: Total balances and debt

Steps you can take to improve your credit score

You should aim to be in the good to excellent credit score ranges. At those ranges you have access to the lowest interest rates and the largest variety of credit products. If you’re in the poor, fair, or average credit score ranges, you should work on building your credit. To do this you can start with secured credit cards or cards with lower credit limits.

Also pay attention to how much you use the card, also called your credit utilization rate. Make sure you only utilize up to 30% of your credit limit. And when you do use your credit card always pay your credit card balance in full and on time to build your credit score.

If you make timely payments and use your credit card wisely, your credit score will gradually increase. This means you pay less interest on loans and credit cards in the future.

Continental Finance is one of America’s leading marketers and servicers of credit cards for people with less-than-perfect credit. Learn more by visiting ContinentalFinance.net

Author: Greg Knotts

Greg Knotts is the VP of Marketing, CDMP, at Continental Finance Company, LLC in Wilmington, DE. A persuasive and results driven leader, Greg has more than 20 years experience in marketing, operations, relationship management, sales and business development in the credit card industry. He spearheads the Continental Finance Blog and leads the company mission to help cardholders everywhere rebuild and restore their credit through the variety of educational resources, articles and graphics the blog provides each week. View all posts by Greg Knotts